Portfolio manager’s Letter July – August 2013

Triumph Group Inc. is a broad based federation of highly specialized suppliers to the aerospace industry. In the last 15 years Triumph Group Inc. has increased its annual revenue from $250 million to $3.7 billion. The bulk of Triumph Group Inc.’s revenues comes from programs that manufacture planes built for commercial airlines and executive jets. This makes it a way to invest in the rapid growth of the middle class in the rest of the world without ever leaving the United States.

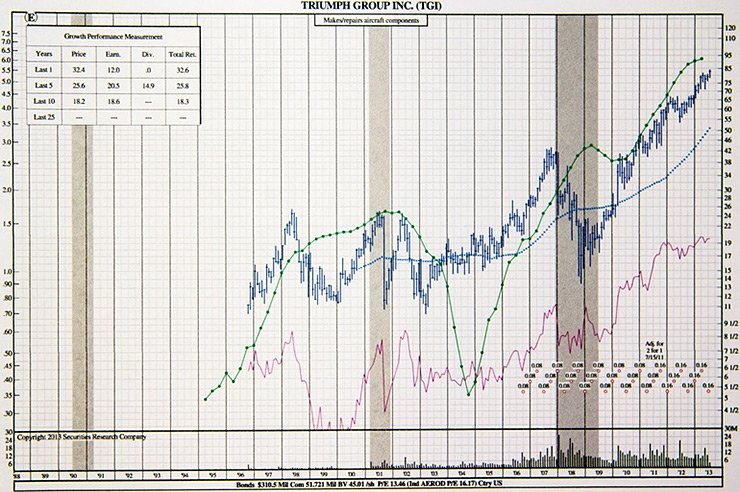

Triumph Group Inc. is listed on the NYSE so the financial statements are in Dollars and accounting is in GAAP. Triumph Group Inc. is up 19% year to date and 260% since December 2008 so the stock is not cheap, but even with this recent appreciation the PE is only 13.3.

Airlines from U.S. and other developed markets are growing slowly, so most of the orders for new planes over the next twenty years will come from rapidly growing airlines in Asia, South America and Africa. Whether or not any of these airlines will ever make a profit is always an open question, but as more and more customers want to travel someone is going to buy airplanes and most of Triumph Group Inc.’s products will eventually end up in planes being flown outside of the U.S.

The Triumph Group Inc.’s largest customer is Boeing, but they have contracts for a couple of Airbus programs, with Lockheed Martin, General Dynamics, Gulfstream and Northrop Grumman. They also are working with Bombardier of Canada and Embraer of Brazil on large programs that are in development.

Much of the Triumph Group Inc.’s consistent 18.7% annual growth in earnings for the last ten years has come through acquisitions. Their acquisition strategy consists of buying small companies (or divisions of larger entities) with highly specialized products in different segments of aerospace industry. Instead of integrating its acquisitions into one large entity with strong central control, they maintain a “Berkshire Hathaway” type structure by allowing each new operation to continue in semi-autonomous form within the larger existing structure.

The advantage of this kind of a larger structure with smaller operating units should be obvious to anyone who has followed Berkshire Hathaway. In keeping the operating units smaller, it encourages innovation, localizes decision making, and limits the damage from mistakes at one of the company’s units to the parent unit. Also this helps each of the operating companies to respond quickly to the needs of its individual customer.

Recent acquisitions include Embee, Inc. for $141 million and Goodrich Pump & Engine Control Systems for $208 million in 2013 fiscal year that ended March 31, 2013. Embee Inc. produces advanced coatings and finishes for parts used in hydraulic systems, landing gear, and electronically activated systems. Goodrich Pump is a fuel system supplier with significant after market potential.

In May, after the start of their 2014 fiscal year, Triumph Group Inc. announced the purchase of Primus Composites from Precision Cast Parts Co. Triumph Group Inc.’s largest recent acquisition was Vought Aircraft Industries which was acquired on June 16, 2010 for a price of $1.05 Billion. Vought Aircraft manufactures aerostructures such as fuselage sections, wing panels and tail sections. At the time of the acquisition, Vought was about twice the size of Triumph Group Inc..

Triumph Group Inc.’s Operating Segments

The Triumph Group Inc. has three operating segments:

- Triumph Aerostructures Group provided 75% of 2013 revenues and 76.0% of operating income. The revenues of this division are derived from the design, manufacture, assembly and integration of metallic and composite structural components for aerospace original equipment manufacturers. It manufactures fuselage panels, door assembly’s wing components, and floor panels for the 747, 767, and 737. Wing panels and flight control assemblies for C-130, KC-46A, Global Hawk and A330.

- Triumph Aerospace Systems Group provided 17.0% of revenues and 16.7% of operating income. The companies in this division design engineer and manufacture a wide range of proprietary components, including landing gear, engine, flight and fuel control systems.

- Triumph Aftermarket Services Group provided 8% of revenues and 7.3% of operating profit; its companies serve aircraft fleets, notably commercial airlines, the U.S. military and cargo carriers, through the maintenance, repair, and overhaul of aircraft components and accessories.

First Quarter 2014

Triumph Group Inc., reported that net sales for the first quarter of 2014 fiscal year ending June 30 totaled $943.7 million, a six percent increase from last year’s first quarter net sales of $887.7 million. Net income for the first quarter 2014 was $79.0 million, or $1.50 per diluted share, versus $76.3 million, or $1.46 per diluted share, for the first quarter of the prior fiscal year.

Top ten programs in first quarter:

- 747

- 777

- C-17

- Gulfstream 450 & 550

- 787

- 737

- Airbus A330

- Osprey

- 767

- Black Hawk Helicopter

The acquisition of Primus Composites brings the Airbus A 320 close to breaking into the top ten.

Overall, Boeing programs represent 45% of revenue, which is a bit heavy for one customer, but it is in many different programs. This concentration should ease once Bombardier’s 7000-8000 and Embraer’s E2 E-jet programs go into production. Company-wide, commercial aerospace contributed 57% of revenue in the first quarter, military sales 28% and business jets 12%.

On June 7, Triumph Group Inc. announced a $1.7 billion contract to design and build the center fuselage several tail sections for Embraer’s E2 E-jets. These are second generation regional jets with state-of-the-art engines, new aerodynamically advanced wings, and improvements in other systems that Embraer estimates will result in double-digit improvements in fuel burn, maintenance costs, emissions, and external noise. The first delivery of an E-Jets E2 aircraft (the E190-E2) is planned for 2018. Currently, 65 customers from 45 countries have added the current generation of Embraer E-Jets to their fleets.

Triumph Group Inc.’s Programs and Products

Commercial Aircraft Market (57% Triumph Group Inc.’s Business FY2013)

Boeing 747

Testing programs for main and nose landing gear retraction, steering, accumulators and door motors fuselage sections, fuselage panels, doors, rudder components, emergency window frames, composite floor panels, door assemblies, frame assemblies, skin assemblies, wing components, ducting and insulation, engine cowl assemblies, floor beams, Repair and overhaul of control surface components, wing and landing gear actuators, inner cabin panes, window shades.

Boeing 777

Flight control surface components and assemblies, access doors, floor panels, wing components, ducting and insulation, light and air consoles, Landing gear components and assemblies, power engine door opening system, alternate power pack, hydraulic system components and assemblies, steering and engine control systems components, water and lavatory controls, window latch kits cabin panes, window shades.

Boeing 787

Advanced composites design and manufacturing technology development, electromechanical brake, design of aft fuselage sections, cargo door selector and sequencing valve, Fuselage panel structural components and detail parts, cockpit floor, window frames, nacelle components, ducting, wing detail parts engine components (Trent 1000 engine), rods and latches.

Boeing 737

Testing programs for main and nose landing gear retract. Flight control surface components and assemblies, door assemblies, window frames, floor panels, wing components, fuselage components, nacelle components, ducting and insulation. Landing gear components and assemblies, engine, fuel, gearbox, flight control and steering systems components, water and lavatory controls. Repair and overhaul of landing gear, hydraulic, steering, fuel, engine and flight control systems components, waste system drain valve, auxiliary power unit, inner cabin panes, window shades.

Boeing 767

Testing programs for main and nose landing gear retract, steering; Tail and wing center sections, aft wheel well, doors, aft body fuselage panels, flight control surfaces, wing components, ducting and insulation, window latch kits; Engine, landing gear, gearbox, steering, flight control and fuel systems components; Repair and overhaul of flight control surfaces, auxiliary power unit accessories, engine components, inner cabin panes, window shades.

Airbus 330

Wing panel components and subassemblies, wing leading edge assemblies, interior components, insulation, structural detail parts Landing gear components, water and lavatory controls Repair and overhaul of flight control surfaces, auxiliary power unit (APU)/ APU accessories, inner cabin panes, window shades.

Military Aircraft Market (28% of Triumph Group Inc.’s business 2013)

Bell Boeing V-22 Osprey

Advanced composites design and manufacturing technology, brake system and engine hydraulic system, main landing gear door assembly, cockpit cabin door assembly, cargo ramp door assembly, fuselage panels and structural frames, wing components; Transmission components and assemblies, engine, hydraulic, steering and flight control systems components, pedal assembly, APU starter motor, mechanical cable control assemblies

Boeing KC-46A Tanker

Tail and wing center sections, aft wheel, aft body fuselage panels, flight control surfaces, wing components, ducting and insulation, lens covers; Engine, landing gear, gearbox, steering, flight control and fuel systems components, water and lavatory controls repair and overhaul of flight control surfaces, auxiliary power unit and engine components.

Lockheed Martin C-130

Flight control system components and assemblies, duct assemblies; Fuel system components, gearbox components and assemblies, vertical stabilizer wire harness, door control system components, landing gear control and steering components; Repair and overhaul of auxiliary power unit (APU)/ APU accessories, engine, hydraulic, flight control, steering, ECS and brake system components.

Northrop Grumman Global Hawk UAV

Full-scale static testing of wing assemblies, de-icing test demonstration components for Triton Integrated wing system assemblies, wing components, radar system components

General Dynamics F-16

Hydraulic system technology development; Landing gear axle, wing components, fuselage components; Landing gear, engine, gearbox, flight and fuel control systems components.

Lockheed Martin F-35 JSF

Full-scale structural carrier suitability testing (Navy version) Fuselage components, bulkhead panels, canopy frames, bonded assemblies; Hydraulic system components, engine components, gearbox components.

Business Jet Market (12% of Triumph Group Inc. Business 2013)

Gulfstream G450

Wing skin forming technology. Wing assemblies, wing components and subassemblies, nacelle inlets, acoustic panels, fuselage components, emergency brake handle. Landing gear, steering and sensor system components, landing gear timer valve.

Gulfstream G550

Wing skin forming technology, laser alignment of wing subassemblies, wing component and structural testing, wing hydraulic system testing. Wing structure and systems design, analysis and build package development. Integrated wing systems, wing components, wing-to-body fairing, winglets, main landing gear doors, flight control surfaces, horizontal stabilizer skin panels. Landing gear, sensor and control systems components, water control, window slider control.

Repair and overhaul of starter motor.

Bombardier 7000 / 8000

Advanced materials technology development, manufacturing modeling and simulation. Wing structure and systems design. Integrated wing systems, wing components, wing-to-body fairing, winglets, flight control surfaces. Flight control system components, auxiliary power system component controls

Cessna CJ4

Aft fuselage cabin and tail cone assemblies. Wing components, fuselage skins, tail components, interior panels and assemblies, pilot/ co-pilot control wheels, crew and cabin windows, sun visor, duct system components, fuel service panels, battery boxes. Landing gear components and power pack. Repair and overhaul of lavatory controls, power transfer unit, heat exchanger, transparency inspection repair and replacement.

Cessna Mustang 550

Wing components, fuselage components, crew and cabin windows, pilot/co-pilot control wheels, sun visor, composite interior and exterior detail parts Landing gear components, power pack Repair and overhaul of heat exchanger, transparency inspection/repair/replacement.

Blog Archive