Elements for foundation successful investors

In his 2014 publication, “Excess Returns: A Comparative Study of the Methods of the World’s Greatest Investors”, Frederik Vanhaverbeke condenses extensive data from the field and attempts to draw some general conclusions regarding successful investors. Given the breadth and depth of the subject, the book’s 300 pages preclude important nuances and details, which would require a work perhaps double this size. Moreover, the competitive nature of the investing drives an evolving creative destruction that eludes fixed declaration. No matter. The author’s outstanding compilation is compelling in its own right and suggests interesting implications.

Vanhaverbeke quickly dispatches the notion that the market-beating returns he studied were due to probability or luck. First, he shows that the 69 top traders and successful investors studied differed by having widely divergent portfolio holdings. He continues by revealing that none of these portfolio successes resulted from a single spectacular stock “home run” holding, given extensive turnover over many years, or from the extensive use of leverage.

In a probability comparison, he calculates that chance of Ed Thorp’s portfolio returns (19.8% compounded for 29 years) being due to random chance was only a few orders of magnitude greater than the probability of finding a single atom by looking in a random place on Earth. Continuing his Efficient Market Heresy, Vanhaverbeke notes that random luck cannot be taught, while the follow-on successes of the trainees and disciples of Richard Dennis, William Eckhardt, Benjamin Graham, Julian Robertson and others stand in stark contrast.

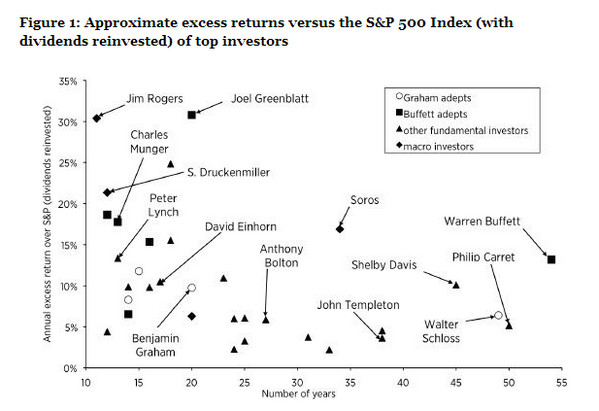

It is noteworthy in the above graph that a commanding majority (29 of 33) of successful investors in the graph above use some form of fundamental value approach, either classical or quality-at-a-fair-price, while only four of the investors succeeded using a macro approach. Given the overwelming attention paid to macro factors in the popular press, it is interesting, if perhaps academic, to ponder the apparent under-representation of macro investors in these findings. What percentages of all investors are macro investors as compared to fundamental investors? Could excess popularity of macro factors contribute to the under-representation of successful macro investors here? Or is macro investing simply more difficult?

Perhaps Vanhaverbeke’s most important finding underscores the value of volatility in achieving superior returns – none of the successful investors outperformed the market every year. Occasional underperformance of the index appears to be an inevitable requirement for outperforming the index in the long run. Interestingly, this underperformance occurred at different times for different successful investors, so market conditions alone do not appear to be the sole cause of this phenomenon.

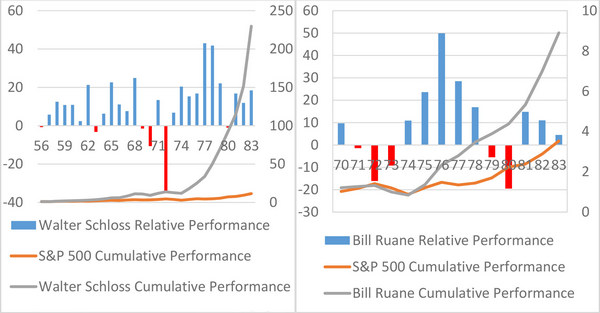

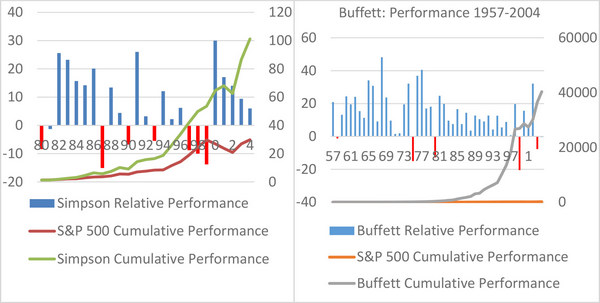

As a further excersize, the following graphs were generated, based on data from Vanhaverbeke’s book, to examine the successful investors relative and cumulative performance compared to the S&P 500 Index:

Three synchronized elements appear to form the foundation of these successful investors:

1. Time

– Harnessing the overwhelming power of compounding

– Spend the necessary time to understand companies, their competitors and industries

2. Technique

– Strategy and implementation must be clearly defined and designed to weather adversity

– Strategy must fit the investor’s areas of interest as well as circle of competence

3. Temperment

– Having the humility and discipline to stay within that circle of competence

– Having the patience, persistence and independence to implement that strategy

Comment: Vanderbeke’s strong effort has produced a thought-provoking book recommended for further reading.

Blog Archive