With the S&P 500 trading at 17.2 times forward earning and the CAPE (Shiller PE ratio) over 27 times earnings the market is clearly index bubble (overvalued) by historical standards. My personal judgment is that the CAPE distorts current conditions because of its strong historical bias. 10 years of history is not representive of current values because the long term trend in corporate earnings is strongly positive. This factor is particularly important when the ten year period in question includes a generational recession.

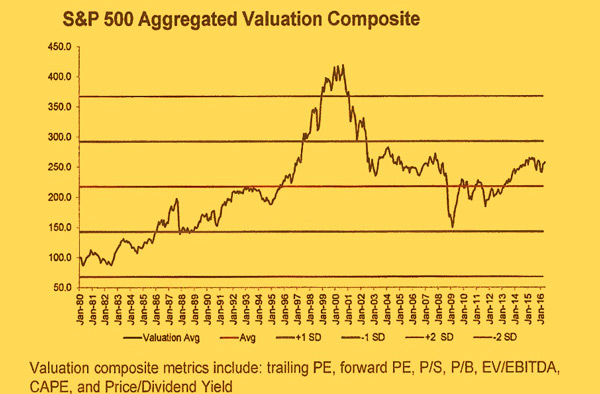

The chart below shows a composite valuation that instead of smoothing earnings but including ten years of history smooths by including trailing PE, forward PE, price to sales, price to book, enterprise value to EBITA, CAPE, and Price to dividend yield. This gives a chart that looks considerably less overvalued (index bubble) than either the chart of the CAPE or the forward PE. This chart has the present values at about .6 of one standard deviation above its mean whereas the CAPE Ratio has the current value about 1.7 standard deviation above its mean.

In view of this current index bubble, Goldman Sachs has recently downgraded stocks to “underweight” and predicted a drop of at least 5% in the S&P 500 in coming months. Ignoring the idiocy of making short term predictions about the direction of the stock market this is probably not a bad bet in view of the volatility of the current market and the fact that we have experienced 10 such corrections in the last 24 months.

Many analysts are estimating that returns from the S&P 500 going forward will remain in the low single digits and they could very well turn out to be correct. But the S&P 500 is not the whole market, and it seems likely to me that the present index bubble is concentrated in certain sectors of the market. For example, those areas that are attractive to refugees’ chased from the from the bond market include utilities, dividend payers and consumer non-discretionary.

The companies that make up these groups tend to be large capitalization stocks, and since the S&P is cap weighted, they probably account for a good share of the S&P 500’s index bubble. It is likely that some of the institutional refugees from fixed income have become closet indexers and are just buying the whole S&P.

Yet the S&P is not the whole market and there remain areas that are not expensive. Pockets of the current market present to asset managers and investors what may be a once in a lifetime opportunity for outperformance. After all, 3% to 4% ROI is not the toughest benchmark.

Of course, you can choose to increase cash and wait for the market to correct. The problem with this approach is that conditions change. If the international economy returns to the growth levels we saw in 1990s and we see a long string of years with double digit growth in earnings, it could be a long wait for that 40%-50% correction.

Where to look Index Bubble

To assemble at portfolio designed to outperform the S&P 500 for the next ten years, it is helpful to review what has been driving the current market. The current bull market is not predominately the creation of hot money looking for short term profit, but the search for yield by investors that need a return on investments above what is provided today by fixed income.

There are many institutional investors that require some kind of return to fund on-going obligations. Endowments must fund their current commitments (scholarships, research grants and charitable contributions. Insurance companies have to pay the claims of their customers and Pension plans have to pay contractual obligations to retirees. Pension fund are always under pressure to meet their assumption of projected investment returns.

So it should be useful to study the investment characteristics that are attractive to these institutions, and assume that a lot of the current index bubble is in the areas they are they find attractive, and that the key to future out-performance with be found in those stocks that are not currently participating. Areas were you may be able to find value includes banking and financial stocks, small and mid-cap stock with a focus on international markets (auto’s, aerospace, chemicals).

Many companies with low PE ratios really are dogs so this approach requires careful selection, including a margin of safety. Close attention must be paid to strong balance sheets and a durable competitive advantage.

Many hedge funds have a short term mind set, so it is possible to find good companies where the price has been driven down by short selling based short term problems, for example, Chicago Bridge and Iron.

The Berkshire is not Index Bubble

While it may be true that Berkshire does not yet have three hundred operating companies, there are already 91 operating directly under Berkshire, and another 185 under Marmon Group. In addition, there all the small companies that are added every year as bolt-on acquisitions (29 in 2015) that never make it to the wholly owned companies list.

Buffett pointed out in this year’s chairman’s letter that 13.5 of Berkshire’s companies would qualify to be included in the S&P 500 if there were not owned by Berkshire, not to mention the $110 billion portfolio of fractional interests in 48 companies, most of which are included in the S&P 500.

Berkshire’s wholly own companies would include fewer dogs and speculative vehicles than normally included in an Index fund.

Berkshire Forward PE ratio 14.4 compared to 17.2 for the S&P 500. This is not index bubble.

No, Berkshire is not an ETF, but if it were, it would demonstrate several advantages over one based on the S&P 500. The management cost of the 25 employees in Omaha would amount to less than one basis point of the company’s market capitalization compared to the 17 basis points at Vanguard.

Berkshire’s $72 billion in cash and $24 billion a year in cash flow give the company the ability to keep adding more companies to its portfolio to increase future earnings, and cash flow, not as in index bubble.

In the event that Buffett gets tired of buying stuff, the best use of that cash will be buying back stock. Berkshire’s cash and cash flow used to buy-back stock gives it the opportunity to continue to increase per share earnings even after there is either no longer anything attractive to buy, or no one in charge with Buffett’s expertise. This is not index bubble.

Blog Archive