Albemarle Corporation is a developer, manufacturer and marketer of specialty chemicals. The company serves customer needs across a range of end markets, including the petroleum refining, consumer electronics, plastics packaging, construction, automotive, lubricants, pharmaceuticals, crop protection, food-safety and custom chemistry services markets.

At the Albemarle Corporation’s Investor day on April 15 in Houston, the CEO gave some background on the company’s ten year record of investor returns, an outline of the Albemarle Corporation’s current structure, and some projections on what to expect in 2014.

Albemarle Corporation has a long history of steady earnings growth. Since the end of 2003 their earnings have increased at the rate of 18% per year and price has appreciated at just short of 17% per year. The Albemarle Corporation and its joint ventures operated 50 facilities, encompassing production, research and development facilities, and administrative and sales offices in North and South America, Europe, the Middle East, Asia, Africa and Australia. It serves approximately 3,000 customers in over 100 countries.

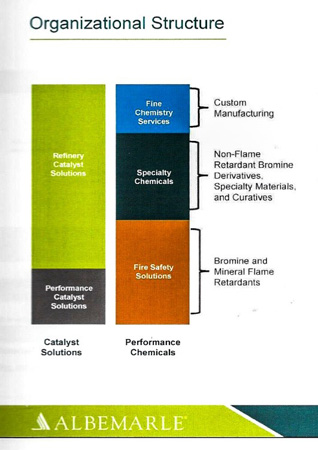

The Albemarle Corporation’s business is currently separated into two divisions, Performance Chemicals which provide 54.9 percent of sales and Catalyst Solutions which is 45.1 percent of sales.

Albemarle Corporation Performance Chemicals

Most of the Performance Chemicals division is built around the use of bromine based products. The largest application of Bromine is as a flame retardant in printed circuit boards, wire and cable, connectors, enclosures for televisions, computers, and smart phones, textiles, foam furniture, insulating foams, and other types of building materials.

Most of the Performance Chemicals division is built around the use of bromine based products. The largest application of Bromine is as a flame retardant in printed circuit boards, wire and cable, connectors, enclosures for televisions, computers, and smart phones, textiles, foam furniture, insulating foams, and other types of building materials.

Bromine is also used in completion fluids for oil drilling, and is used at coal fired power plants to eliminate mercury discharge. Current weakness in bromine prices is caused by drop in demand from coal fired power plants, as utilities switch to natural gas. Bromine is also used in the manufacture of automobiles and trucks, as a flame retardant in the vehicle’s electronics, and is used in radial tires to add strength and puncture resistance.

There are only three significant players in bromine based chemicals, with global market of about $2.75 billion. Albemarle Corporation, Chemtura and Israel Chemicals Limited, Israel Chemicals has 41% of the market, Albemarle Corporation has about 32% and with Chemtura is third with 12%.

An area of growth potential for Bromine use is the energy storage market for facilities generating electricity from renewable sources. Bromine can be used in Flow batteries, which will be important for facilities that generate electricity with wind and solar sources. Flow batteries are large tanks that can store electricity efficiently for use when the wind does not blow or the sun does not shine.

17% of the revenue in the Performance Chemicals comes from Fine Chemistry services, consisting of:

1. Custom services for pharmaceuticals, agriculture and electronics;

2. Intermediate chemicals used in the manufacture of Generic & Pharmaceutical drugs;

3. Intermediate chemicals, used in the manufacture of fertilizer, pesticides, and other chemicals used in agriculture.

Albemarle Corporation Catalyst Solutions

Catalyst Solutions will generate about $1.2 in revenue this year in a global industry that is expected to generate $10.7 billion. In the first quarter of this year, Catalyst Solutions provided 45 percent of Albemarle Corporation sales and a nearly identical share of the company’s bottom line (44.6 percent). A catalyst is a substance that initiates, accelerates or selectively directs a chemical reaction. There are many forms and types of catalysts and they can be liquid or solid. They are used at some stage in the manufacture of 90 percent of all commercial chemicals. Catalysts Solutions has two divisions, Refinery Catalysts and Performance Catalysts.

Performance catalysts that are used in the production of many different kinds on plastics, one class of catalysts will produce high density polyethylene which is used to make milk jugs, detergent bottles, butter tubs, garbage containers and rigid plastic pipe for water pipes, storm sewer and sanitary sewer. Other catalysts will produce low density polyethylene, where products range from agricultural films to Saran wrap, bubble wrap, medium-density polyethylene used for gas pipes, plastic bags, shrink-wrap, and packaging film.

Refinery catalysts are used by refineries to help process Crude oil into various end products such as gasoline, jet fuel, diesel fuel, etc., which with the use of different catalysts can produce more polyethylene. Refinery catalyst design is a complex and research intensive process. Catalysts are designed at atomic and molecular level to meet the specific needs of each individual refinery. Refineries are massive structures, costing billions of dollars; and taking years to build. Most refineries in this country were built many years ago.

Different refinery designs require catalysts specific to each design. The Catalyst has to be built to meet the requirements of the particular refinery, the type of crude that will be processed and the end product requirements of refinery’s customers. Different crudes require different catalysts. Each refinery has its own set of customers – some customers want more diesel fuel, or more gasoline or more jet fuel, or maybe their market requires more plastics.

For the last twenty years refineries in the United States have spent hundreds of millions of dollars to convert the older facilities to refine heavy crude. Now, the tight oil coming from shale is very light, but with impurities that vary from one location to the next, requiring a catalyst designed to deal with impurities found specific crude. To make matters worse, the refineries recently rebuilt to handle heave crude cannot run on tight oil alone, because there is not enough carbon in the tight oil to generate the heat needed to run the reactors designed for heavy crude.

So, refineries in the US are importing heavy crudes from Mexico and Canada to mix with light crude coming from domestic shale oil. There is currently not enough refining capacity in the U. S. to handle all the light crude being produced from the shale oil, with the result that our light crude is now selling at a discount to world oil prices.

In March, I attended Albemarle Corporation’s FCC Catalyst Academy in Houston, including two days of classes on the structure and design of refinery catalysts and a tour of their catalyst plant in Bay Town, Texas. The attendees were mainly customers and employees, giving me a better understanding of the complexity of catalyst design and how closely Albemarle Corporation works with the people that are running the customer’s refineries. It was a good chance to get to know some of the high level employees in this division, and to get some insight into how they feel about their jobs and the Albemarle Corporation they work for.

All of Albemarle Corporation’s refinery catalysts are custom made. Each batch is shipped with the characteristics required by a particular refinery and current feed stock that the refinery is using. The plant in Bay Town, Texas has three separate laboratories to develop new catalysts and test the effects of those catalysts on the crudes their customers are using. This ability to customize each batch of catalysts, and study the effects of their catalyst on the customers feed stocks provides much of Albemarle Corporation’s competitive advantage in catalysts.

Shale gas has provided the U.S. with feedstock price for plastics manufacture that is one half the cost of Europe and one third of the cost of feedstock in Asia. This has prompted Chevron Phillips Chemical, Exxon Mobil, and Dow Chemical all to start construction of huge ethane – polyethylene manufacturing complexes in the Houston area. The combined cost of these facilities, all which are scheduled for completion in 2017, will be in excess of $15 billion. While it will be a while before these plants will be in production they should provide Albemarle Corporation an interesting market for their performance catalysts.

Blog Archive