Portfolio manager’s Letter March 2004

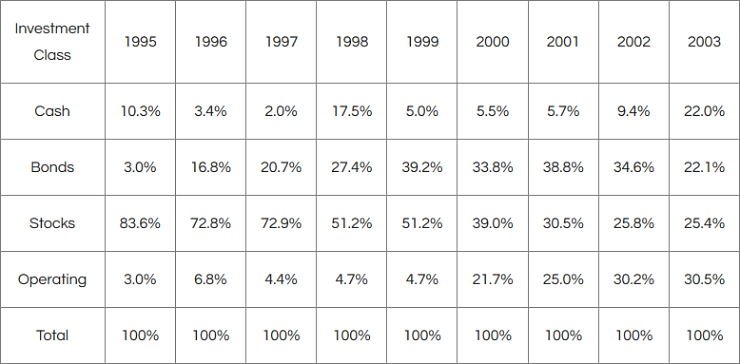

I have taken his table “Asset Allocation Berkshire Hathaway” and added a couple of columns on the left side to cover the period that included the 1996 acquisition of GEICO. The result is a dramatic representation of Warren Buffett’s move away from the equity market. The move is very Warren Buffett in that the shift is massive, but it was handled in such a way that unless you are really paying attention you would not notice. This table tells us better than mere words what is going on in Warren Buffett’s mind.

Notice the sharp increase in cash in 2003 year and a dramatic sell-off of the company’s holdings of debt. This is a very clear indication of Mr. Warren Buffett’s feelings about the bond market. The large holdings of cash (that yield less than 1%) must be painful to some one that likes to get 10% after-tax, and so speaks volumes about present lack of attractive investments.

Table One – Asset Allocation Berkshire Hathaway

Asset Class by Percent

In 1995 the total value of the equity portfolio was $21 billion compared to something north of $35 billion today. But as you can see from table one, Warren Buffett has been able to drastically reduce Berkshire Hathaway’s exposure to the risk of a decline in the equity market.

Table two indicates that 2002 was the first year of on-balance stock purchases since 1996, but the amount of purchases were not significant; it was mostly caused by lack selling. The main reason for the lack of sales in 2002 was probably the market decline. In last years annual report he said that stock values where still not attractive, but his actions show that in 2002, while he still was not buying, at least values where such that he had just about stopped selling.

Warren Buffett’s method of fashioning this radical restructuring of Berkshire Hathaway’s assets is very complicated but fascinating. There has been some liquidation of equity positions. Table two indicates that Berkshire Hathaway liquidated, on balance, about $10.2 billion in equities since 1995.

Table Two – Berkshire Hathaway – 16 Year Equity Purchases

| Year | Equity Purchases | Equity Sales | Realized Gains | Net Purchases (Sales) |

| 2002 | $1,756 | $1,406 | $637 | $350.00 |

| 2001 | $1,075 | $3,881 | $1,363 | $2,806.00 |

| 2000 | $4,145 | $6,870 | $3,955 | $2,725.00 |

| 1999 | $3,664 | $4,355 | $1,365 | $691.00 |

| 1998 | $1,865 | $4,868 | $2,415 | $3,003.00 |

| 1997 | $714 | $2,016 | $1,106 | $1,302.00 |

| 1996 | $1,423 | $1,531 | $2,484 | $108.00 |

| 1995 | $1,460 | $1,353 | $194 | $107.00 |

| 1994 | $3,050 | $1,467 | $91 | $1,583.00 |

| 1993 | $859 | $1,189 | $546 | $330.00 |

| 1992 | $913 | $100 | $89 | $813.00 |

| 1991 | $810 | $523 | $192 | $287.00 |

| 1990 | $729 | $262 | $34 | $467.00 |

| 1989 | $740 | $822 | $224 | $82.00 |

| 1988 | $1,709 | $104 | $132 | $1,605.00 |

| 1987 | $550 | $178 | $29 | $372.00 |

| 16 Year Totals | $25,462 | $30,925 | $14,856 | $5,463.00 |

But, the major influence on the change in the asset balance has been the acquisition of GEICO and GenRe with their large bond portfolios, and the acquisition of complete companies in the last five years.

List of Berkshire Hathaway’s Holdings

We have completed our update of the list of Berkshire Hathaway’s holdings for 2003 taken from the companies 13F filings with the SEC. The list shows a small but steady liquidation of the equity portfolio in 2003. People have said, and I agree, that most of the buying and selling that appears now on Berkshire Hathaway’s 13Fs are the work of Lou Simpson. In any event, the year-long rally in 2003 appears to have driven Berkshire Hathaway back to being a net seller.

In the 4th quarter Berkshire Hathaway sold the last of its positions in Dunn & Bradstreet, Duke Energy, and Level 3.

Blog Archive