Portfolio manager’s Letter November – December 2012

Leucadia National Corporation and Jefferies Group, Inc. announced last month that the companies have approved an all stock merger agreement under which Jefferies’ shareholders will receive 0.81 of a share of Leucadia National Corporation common stock for each share of Jefferies common stock they hold. The merger is expected to close during the first quarter of 2013. Leucadia National Corporation currently owns approximately 28.6% of the Jefferies outstanding shares. Leucadia National will issue 133.2 million common shares to Jefferies holders which will raise Leucadia’s total outstanding common stock to 377.7 million shares.

Upon the execution of the merger agreement, Richard Handler, Chief Executive Officer and Chairman of Jefferies, will assume duties as CEO of Leucadia National Corporation and Brian Friedman, Chairman of the Executive Committee of Jefferies, will become the president of Leucadia National Corporation. Joseph Steinberg, currently the president and a director of Leucadia National Corporation, will become Chairman of the Board of Leucadia National Corporation and will continue to work full time as an executive of Leucadia. Ian Cumming will retire as Chairman of the Board and Chief Executive Officer of Leucadia National Corporation upon the closing of the transaction and remain a Leucadia National Corporation director. The other Leucadia National Corporation officers will continue in their present positions.

Jefferies, which will be the largest business of Leucadia National Corporation, will continue to operate as a full-service global investment banking firm in its current form. Jefferies will retain a credit rating that is separate from Leucadia National Corporation’s. Following the transaction, 35.3% of Leucadia National Corporation’s common stock will be owned by Jefferies’ shareholders. Leucadia National Corporation’s Board of Directors has approved share repurchase program authorizing the repurchase from time to time of up to an aggregate of 25 million Leucadia National Corporation common shares. Leucadia National Corporation’s Board also has indicated its intention to continue to pay dividends at the annual rate of $0.25 per common share, but on a quarterly basis following the merger.

Cummings and Steinberg are managers of Leucadia National Corporation

There is no question that Leucadia National Corporation will be an entirely different beast when the merger is completed, and this merger seems to indicate that the company’s main business going forward is going will be in investment banking. For the shareholder, this raises the question as to what was behind this decision by Leucadia National Corporation’s two managers who have one of the best records on the street for the last twenty years.

Warren Buffett in a recent appearance on CNBC complained that today’s interest rates make it more difficult to find attractive investments because of the competition from private equity. Leverage is so cheap that any decent opportunity gets jumped on by private equity funds and Buffett’s usual advantage of large piles of ready cash while not meaningless is certainly less of an advantage than under normal conditions.

So it may be that part of the problem for Ian Cummings and Joseph Steinberg may be that they just do not see the kind of deals today that they used to see. Rather than chasing mediocre deals they have decided to turn Leucadia National Corporation to a different direction. Perhaps, this might also help to explain why Mr. Cummings has decided to retire at the ridiculously young age of 71.

While the combined company will be quite different from the company that has been run so successfully for so many years by Misters Steinberg and Cummings, it will have many interesting strengths and opportunities. The Merger will increase Leucadia National Corporation’s Book Value to $9.3 billion from $6.2 billion as of the end of the third quarter of 2012, but decrease book value per share from almost $27 per share to $24.7 because of the increase of the number of shares outstanding upon completion of the merger.

It will also provide Jefferies with a considerable cash cushion; with Jefferies current assets of $42.1 billion, the leverage ratio of assets to liabilities for the combined enterprise would drop from 8.3 to 4.5. Leucadia National Corporation’s cash and investments available for sale stood at approximately $3.0 billion in October after receipt of the final payment on the Fortescue Metals Group note and payment of short term debt of $445 million.

Jefferies and Leucadia National Corporation have worked together for quite a while on countless financings and strategic transactions, including Jefferies High Yield Funds, Jefferies High Yield Holdings joint venture, and it was Jefferies that first brought Fortescue Metals Group to the attention of Cummings and Steinberg in 2006. Fortescue Metals Group is an Australian Iron ore mine that I have written about before at This Time it is Different.

Historical Comparisons

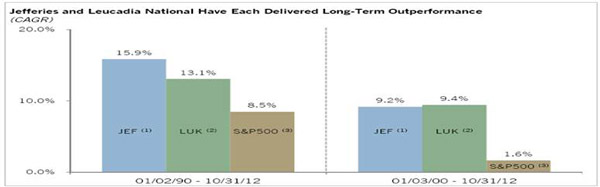

The chart below compares the performance history of Leucadia National Corporation and Jefferies to the Standard and Poor’s 500 Index since 1990 when present management took over Jefferies, and since 2000 when the current Bear Market began.

For both periods, Jefferies and Leucadia National Corporation have out–performed the broad market by very substantial margins. Significantly, the best relative performance has been in the last twelve years when JEF and LUK have shown an almost 10% annual return while the S&P 500 has barely broken even.

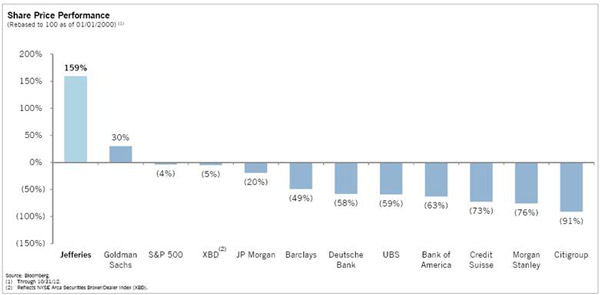

Jefferies survived the banking crisis relatively intact and has remained solidly profitable despite the volatile trading environment in global markets since 2009. They has been actively recruiting people from its big wall street rivals, so that as all the these banks have been lowering expenses and cutting payroll, Jefferies has been picking through the pieces and going after key personnel that have been leaving the troubled New York banks.

At this point, Jefferies has the highest ratio of payroll to revenue of anyone in the industry. Access to Leucadia National Corporation’s capital should allow Jefferies to rapidly increase revenue without having to leverage up too much, use their new employees to good advantage, and improve pre–tax margins. The additional capital should also help with recruiting and strengthen Jefferies competitive position. The chart below compares JEF’s performance to its large investment bank competition throughout the banking crisis, and gives us a picture of a much more conservative approach to investment banking than what was in place throughout the industry.

On November 23 the day after the merger announcement Leucadia National Corporation’s stock was down and Jeffries was rallying strongly, but in the last couple of weeks Mr. Market seems to have decided he likes the deal better the more he thinks about it, and both stocks have been rallying nicely. In addition to the combined company’s potential in investment banking, the management believes that existing portfolio holdings, such as National Beef, Berkadia, and Inmet offer attractive opportunities for internal expansion in the future.

Blog Archive