Composite Returns

Losch Management composite return

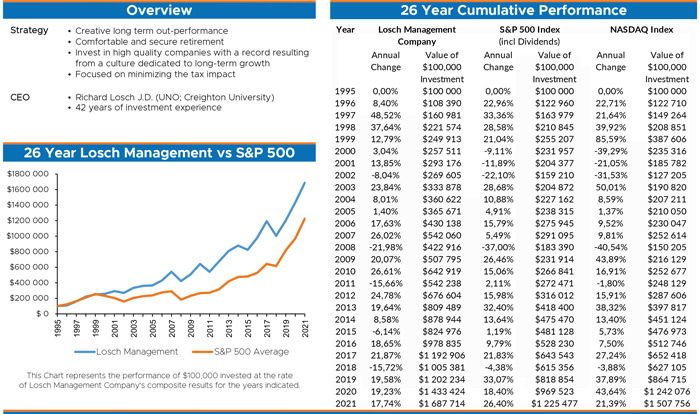

We are pleased to show you our investment strategy results. Losch Management believe that our strategy should continue to deliver attractive composite returns to those investors with a sufficiently long time horizon.

For the 26 years, we delivered higher return to our investors compared to the composite return of the Standard and Poor's 500 and the NASDAQ averages. While the risk level was 25% lower than the risk of the market.

Please have a look at our factsheet for full details (click to enlarge).

Losch Management Company's results calculated to assure conformance to the Global Investment Performance Standards. The standards were establish by the CFA institute to establish global standards for calculating and presenting investment performance.

Few years ago, Losch Management Company's results audited to assure conformance to the Global Investment Performance Standards (click to enlarge).

All the data computed by software developed by Portfolio Center from Performance Technologies.

The results obtained from trade and price data that downloaded from customer accounts at Charles Schwab for the period from December 31, 1995 to October 2003, and October 2003 to date from TD Ameritrade.

Past results are no guarantee of future performance. It is certainly Losch Management Company's do all that we will be able to outperform the market in the future, as in the past.